Business Tax Overview

Business Tax Overview

The Township of Haverford imposes three business related taxes under Act 511: the Business Privilege tax, the Mercantile tax, and the Local Services Tax. All individuals or companies doing business within the Township should obtain an annual business tax license issued from Tri-State Financial Group, LLC, the Township's official business tax collector.

Tri-State Financial Group, LLC

http://tfgtax.com/

Go to the far right side of the website, then click on

"Haverford Township Tax Forms"

610-270-9520.

The Mercantile Tax (MT) is assessed on all retail and wholesale related business activities while the Business Privilege (BPT) is assessed on all other business activities. Both taxes are based on gross receipts. Business Privilege taxes are at the rate of 1.5 mills ($1.50 per $1,000) of gross receipts and Mercantile taxes are at the rate of 1.5 mill ($1.50 per $1,000) of gross retail receipts or 1.0 mills ($1.00 per $1,000) of gross wholesale receipts. Returns are due April 15 of each year for activity in the previous calendar year.

The Local Services Tax is imposed upon each individual engaged in any occupation in the Township. It is the responsibility of the employer to deduct, from their employees, the tax of $52 per year at a rate of $1 per week employed. This tax is imposed on all income earned in the Township whether salary, wages or commission. The employer must then file quarterly returns to Tri-State Financial Group, LLC remitting the taxes deducted. All self-employed individuals are required to remit their tax as well. Anyone earning less than $12,000 during the year may file an exemption form with their employer. It is the employer's responsibility to implement this exemption. If the employee has not filed an exemption and has paid the tax, the employee is entitled to a refund upon presentation of proof of earnings. Also, anyone who may have had the tax deducted twice in the same year from different employers is entitled to a refund upon presentation of proof of deductions.

Tax Collection and Compliance

All questions regarding forms, compliance and collection with the tax should be directed to Tri-State Financial Group, LLC

Audit and Compliance Program - the Township reserves the right to audit and inspect all books and records of a taxpayer to support the information reported on taxpayer filed returns.

Property Tax Overview

Property Tax Overview

Township property taxes fund a multitude of services carried out by the more than 300 full-time and seasonal employees of Haverford Township. These services include police protection, financial support to five (5) area Fire Companies, basic and advanced life support ambulance services, financial support to the Township Library, snow and ice removal, road maintenance and repair, street light maintenance and repair, traffic signal maintenance and repair, park maintenance, park and recreation program development, building codes and zoning enforcement and compliance with health standards and regulations.

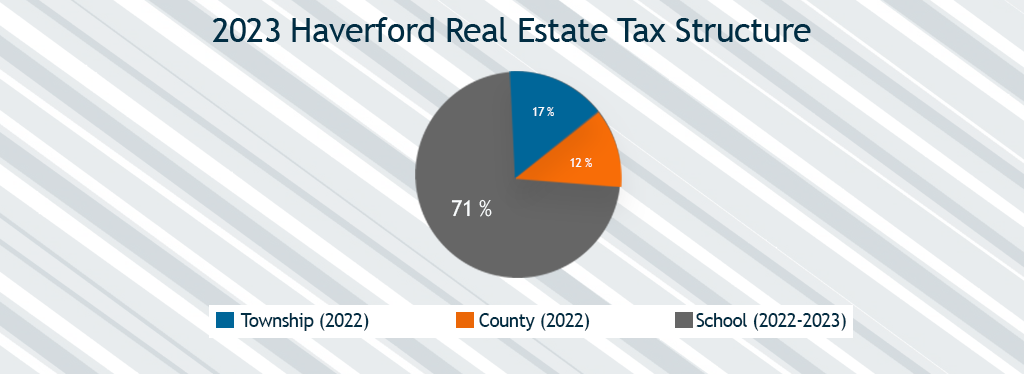

Properties are taxed based on information and assessments provided by the Delaware County Assessors Office. Questions regarding individual property assessments should be directed to the County officers at (610) 891-4379. It's important to note that a property's total real estate taxes are comprised of three taxes from three different taxing authorities. Each taxing authority -- Delaware County, Haverford Township School District and Haverford Township -- each set their own rates and bill and collect their own taxes.

Each year as part of the budget process, the Board of Commissioners enacts an Ordinance setting the Township property tax millage rate for the coming year. Taxes are figured by taking the property assessment and multiplying by the millage rate in effect for that particular tax year and dividing by 1000. A sample annual tax bill, using an average property (residential and commercial) assessment of $346,000, is calculated as follows:

Haverford Township Taxes: $346,000*4.545 mills/1000 = $1,573

Delaware County Taxes: $346,000*3.873 mills/1000 = $1,340

Haverford Twp School District: $346,000*18.8951 mills/1000 = $6,538

Annual sewer rent and trash collection fees are also billed together with the Township tax on the same bill.

Township tax bills are generally mailed out by February 1 of each year and can be paid in person at the Township building or mailed to either the Township building or the Township lockbox. **Payments can no longer be made at Citizens Bank branches**

There is a 2% discount for payment made by March 31 and a 10% penalty for any payments made after May 31. If a property tax bill is unpaid as of December 31, the Township turns the tax portion of the bill over to Delaware County Tax Claim Bureau, where the property is then subject to Sheriff Sale. The sewer rent and trash fee portion of the delinquent bill remains at the Township level. These amounts must be paid directly to the Township and the property owner must contact the Township directly for final payoff figures. Payoff amounts must be requested in writing for the same fee as a tax certification.

For further information on the other two components of your total real estate tax bill, please contact the following:

• Delaware County (610) 891-4278

• Haverford Township School District (610) 853-5900 ext. 7104